38 call option payoff diagram

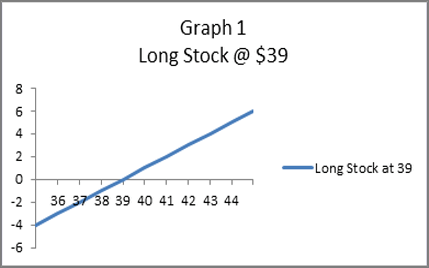

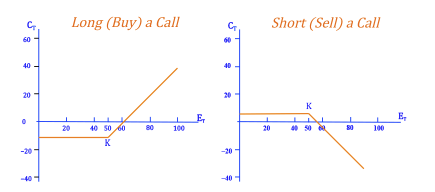

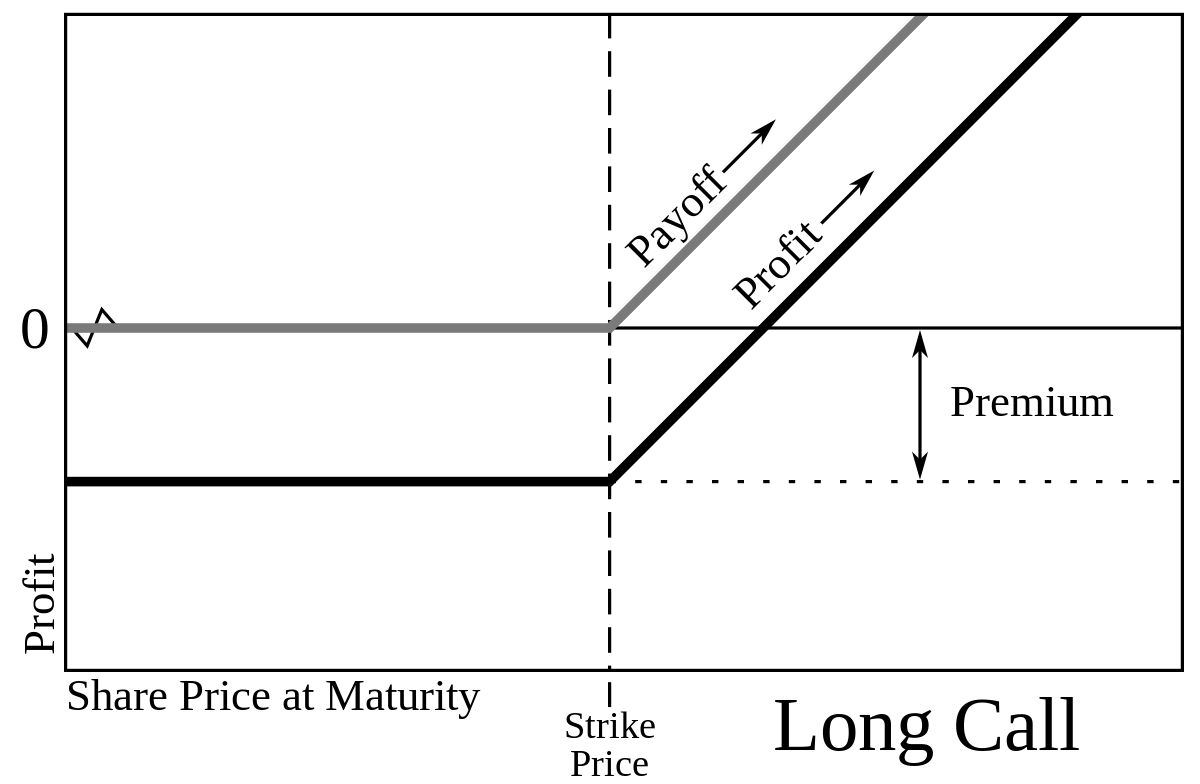

The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. Basically, you multiply the profit or loss by -1.. For detailed explanation of the logic behind individual sections of the graph, see long call option payoff.. Short Call Payoff Formulas. The formulas are the same as those for long call option strategy, only the ... A payoff graph will show the option position’s total profit or loss (Y-axis) depending on the underlying price (x-axis). What we are looking at here is the payoff graph for a long call option strategy. In this example the trader has bought a 20 strike call for $2 per contract (or $200 for a standard option contract representing 100 shares).

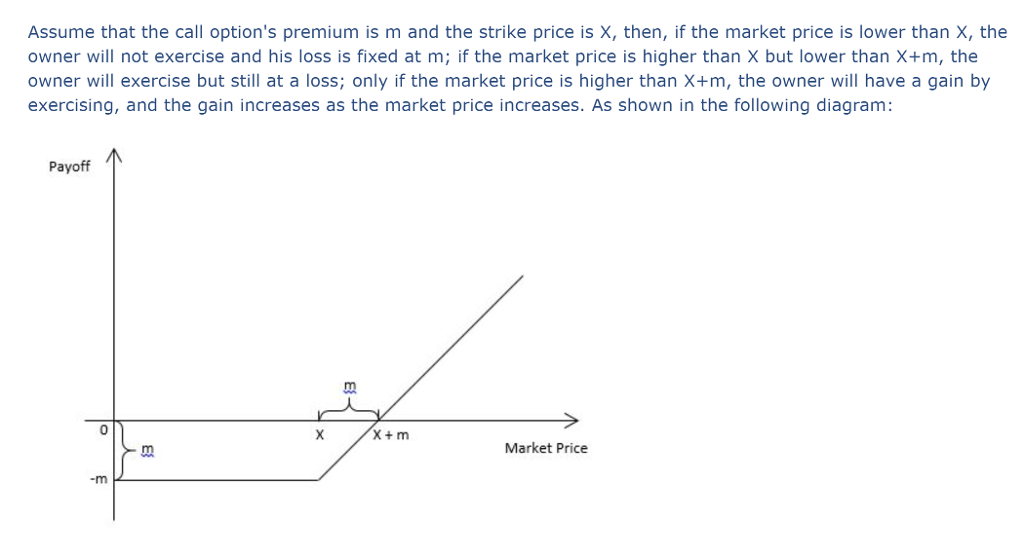

Business; Finance; Finance questions and answers; PS Option and option strategy a. Call option Payoff (profit or loss) diagram: Draw payoff diagram at expiration date ...

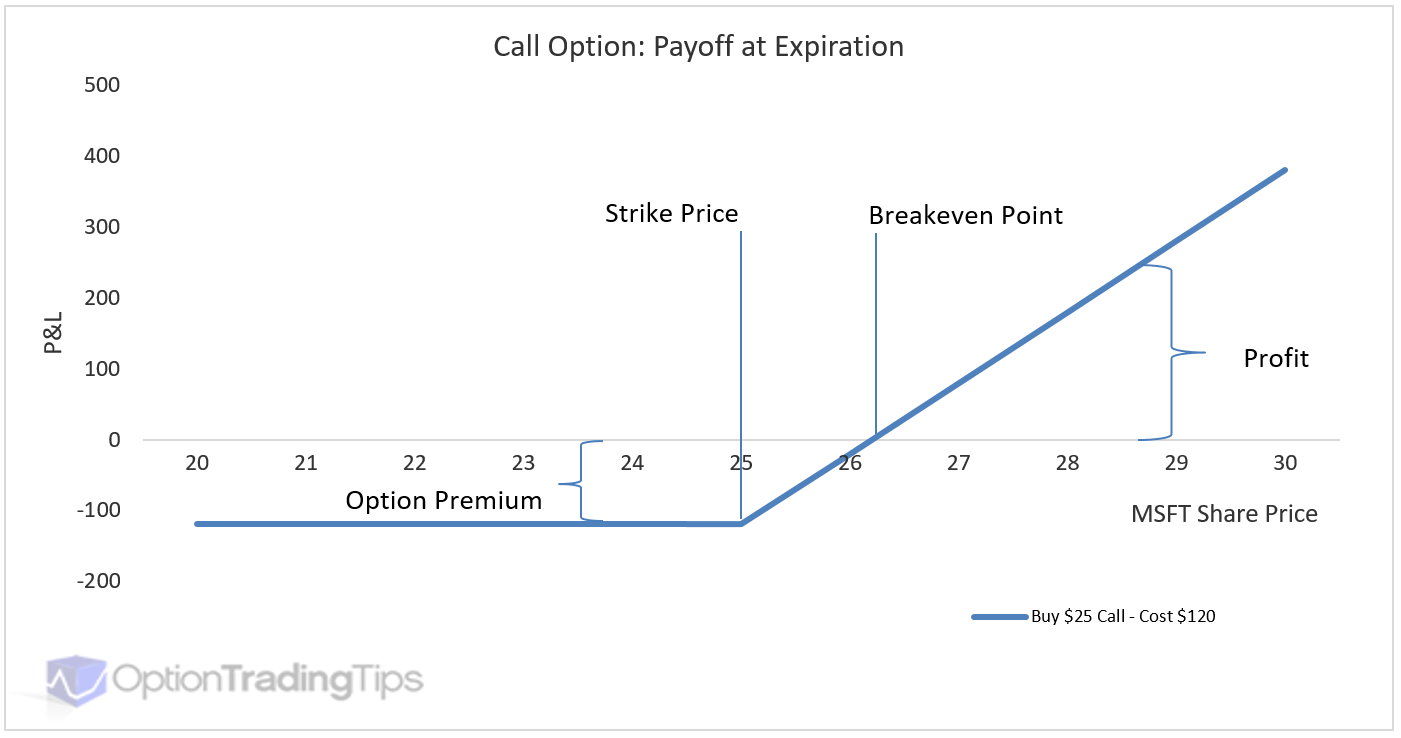

Call option payoff diagram

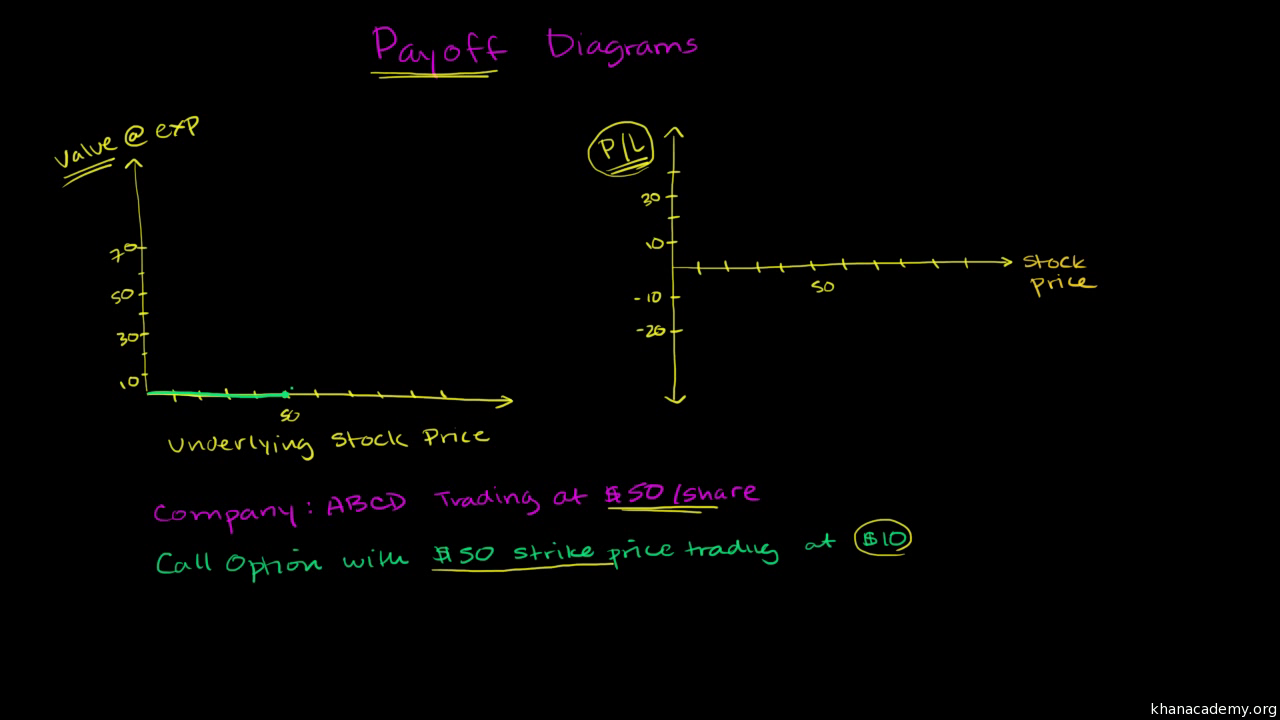

A convenient way to envision what happens with option strategies as the value of the underlying asset changes is with the use of a profit and loss diagram, ... Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. Transcript. A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan. This is the currently selected item.

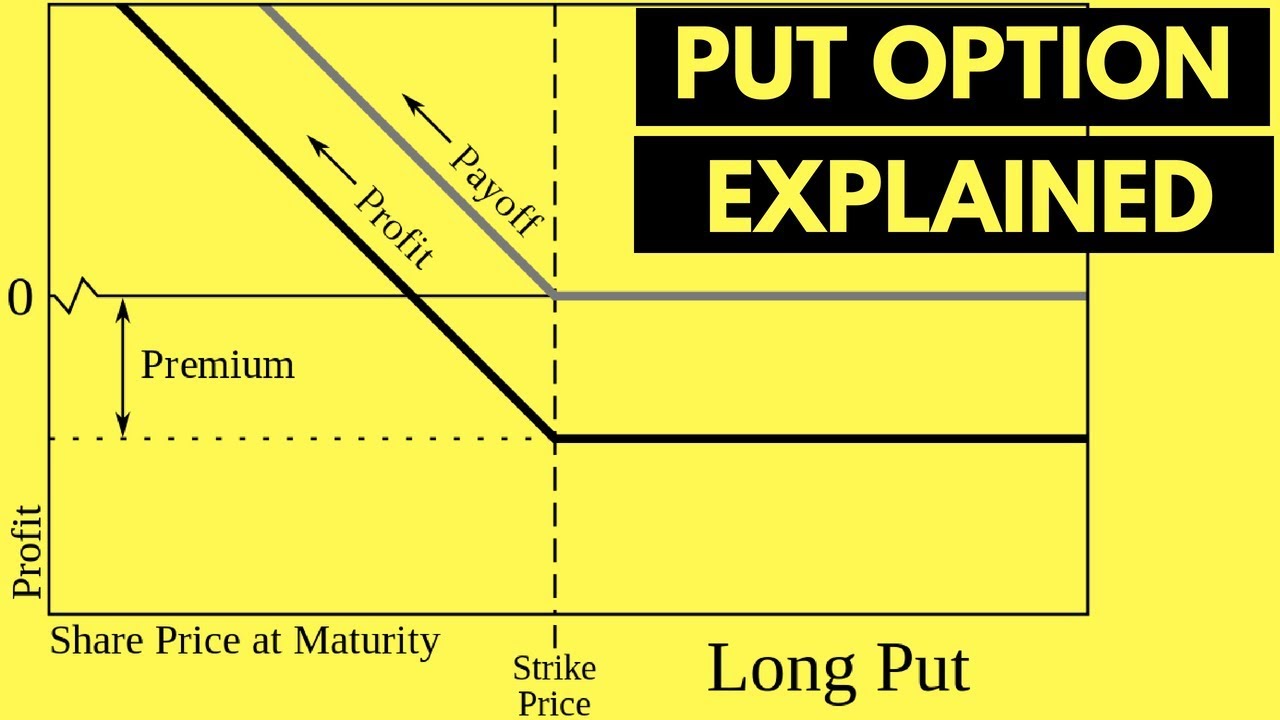

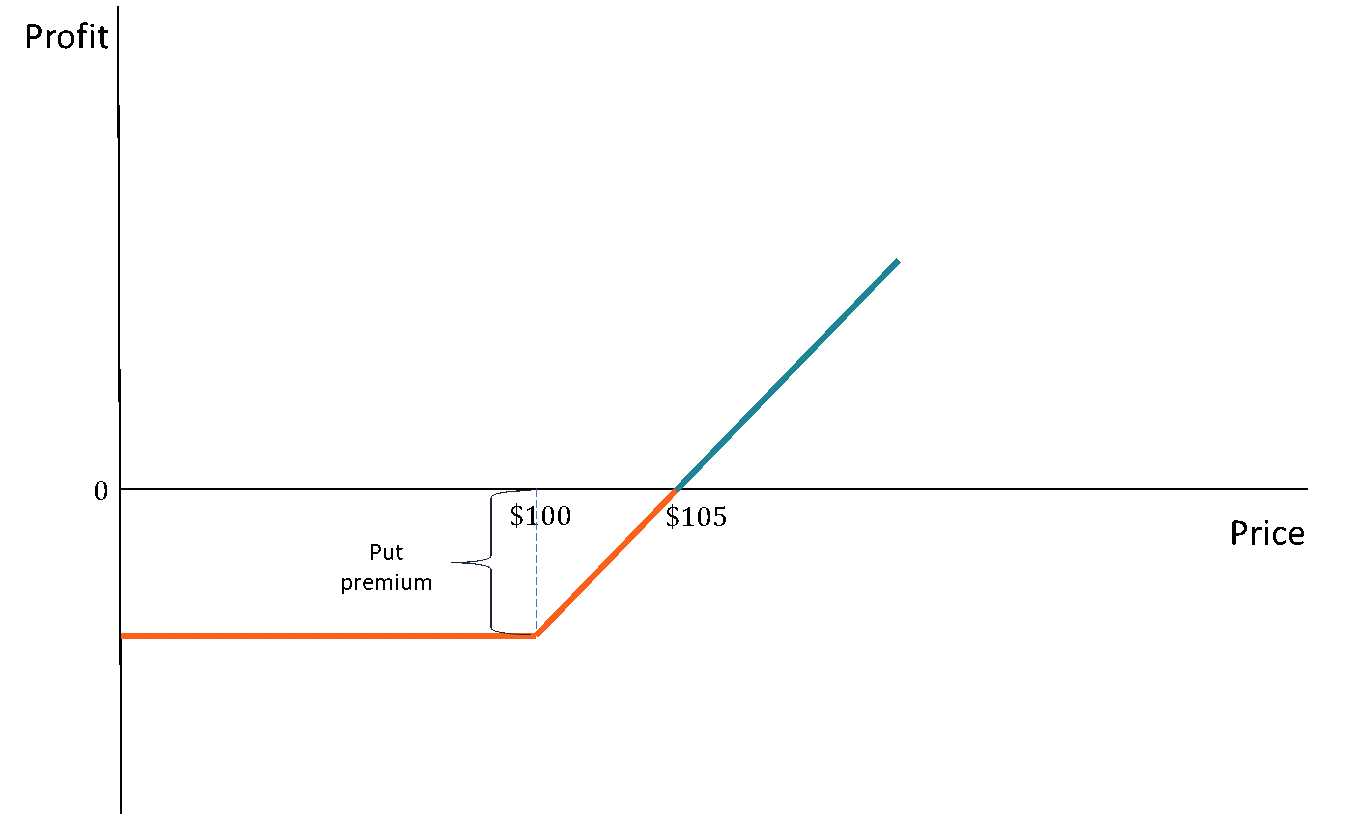

Call option payoff diagram. For options, profit-loss diagrams are simple tools to help you understand and analyze option strategies before investing. When completed, a profit-loss diagram ... The profit from writing one European call option: Option price = $10, Strike price = $200 is shown below: Put Options. By now, if you have well understood the basic characteristics of call options, then the payoff and profit for put option buyers and sellers should be quite easy; simply replace \( “S_T-X” \text{ by } “X-S_T” \). The below covered call option payoff is from Interactive Brokers. The covered call option was an AAPL 110 strike call sold for $4.20 per contract or $420 in total and a long position bought at $106.10 per share. The breakeven price at expiration is $101.90 (long position bought price minus premium received). The payoff diagram of a put option looks like a mirror image of the call option (along the Y axis). Below the strike price of $100, the put option earns $1 ...

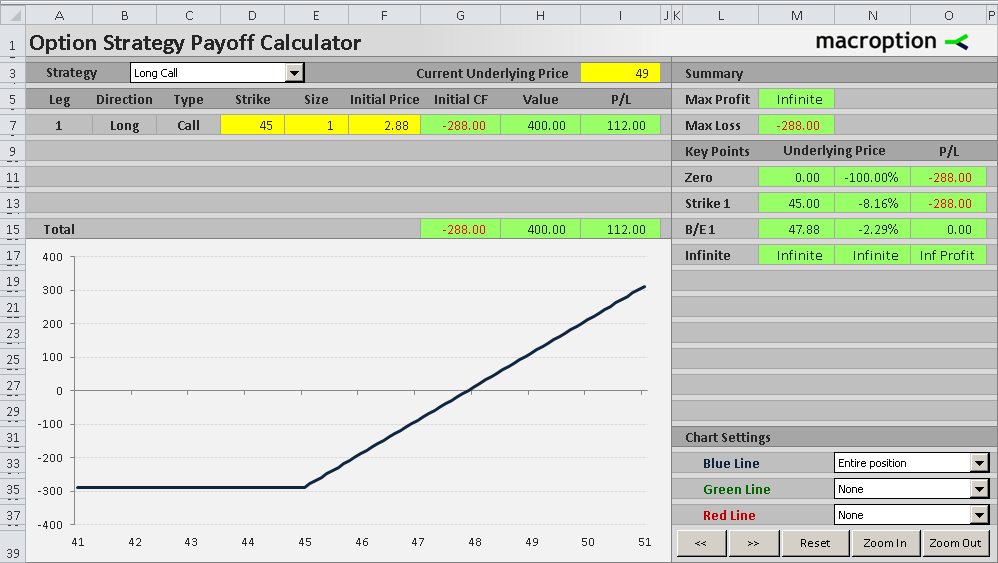

This is part 5 of the Option Payoff Excel Tutorial, which will demonstrate how to draw an option strategy payoff diagram in Excel.. In the previous four parts we have explained option profit or loss calculations and created a spreadsheet that calculates aggregate P/L for option strategies involving up to four legs.For example, the screenshot below shows an iron condor made on strikes 45/50/55 ... The short call option was an AAPL 125 strike call sold for $2.60 per contract or $260 in total. The breakeven price at expiration is $127.6 (strike price plus the premium received). The blue line shows the expiration payoff that you are now familiar with and the purple line shows what is known as a “T+0” line. Call Option Payoff Diagram. Buying a call option is the simplest of option trades. A call option gives you the right, but not obligation, to buy the underlying security at the given strike price. Therefore a call option’s intrinsic value or payoff at expiration depends on where the underlying price is relative to the call option’s strike ... Transcript. A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan. This is the currently selected item.

Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. A convenient way to envision what happens with option strategies as the value of the underlying asset changes is with the use of a profit and loss diagram, ...

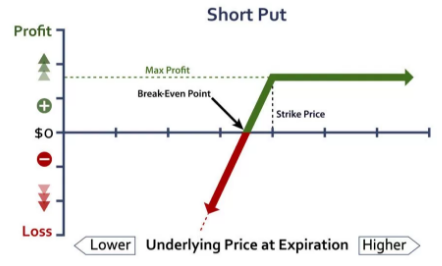

Short Put Option How To Trade Short Put Payoff Charts Explained Options Futures Derivatives Commodity Trading

Put Option Definition Intrinsic And Time Value Payoff Diagram Example Covered And Uncovered Put Option

Call Option Definition Intrinsic And Time Value Payoff Diagram Example Covered And Uncovered Call Option

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

0 Response to "38 call option payoff diagram"

Post a Comment