41 private equity fund structure diagram

by LLP Parke · 2011 — The structure of a private equity fund generally involves several ... LP entities, see Choosing an Entity Comparison Chart (http://.20 pages 29-07-2020 · The subscription model is used because of its pricing structure, ... Alcor Fund which is a global private equity fund that acts as an advisory with a strong knowledge of the investment market. ... A conceptual business model is a diagram that demonstrates to us …

Example Private Equity Waterfall. Below is a private equity waterfall diagram showing a Preferred Return with two hurdle rates that the investment must reach before the cash flow splits begin to change. The light blue bar (the GP’s portion of distributions) becomes larger (or is “promoted”) as these performance hurdles are achieved.

Private equity fund structure diagram

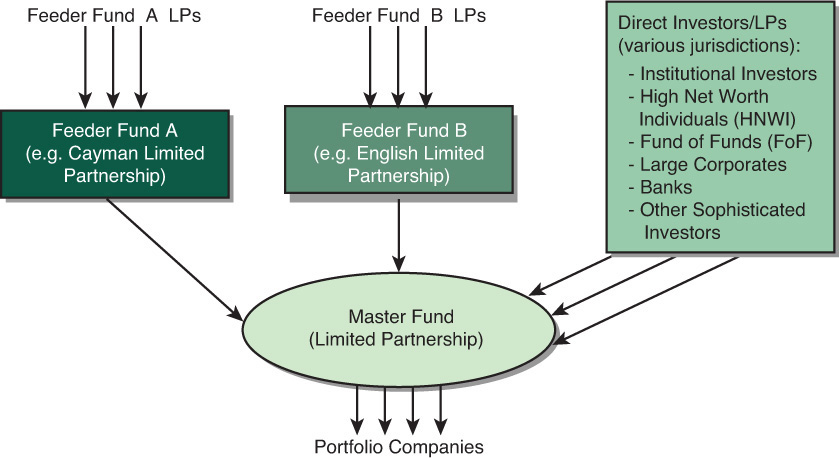

How the Master-Feeder Structure Works. The diagram below depicts how a typical master-feeder ... Creating a master fund generates economies of scale Economies of Scale Economies of scale refer to the cost advantage experienced by a firm when it increases its level of output.The advantage arises due to ... private equity, FP&A ... 11-04-2018 · The Equity Capital Markets Team Structure: 3 or 4 Teams in 1. Most people speak about ECM as if it’s a single group, but it is actually divided into a few different subgroups at most banks: Equity Origination: This team pitches companies on raising capital and then executes financing deals such as IPOs and follow-on offerings. Although minimum investments vary for each fund, the structure of private equity funds historically follows a similar framework that includes classes of fund ...Private Equity Fund Basics · Fees · Limited Partnership Agreement

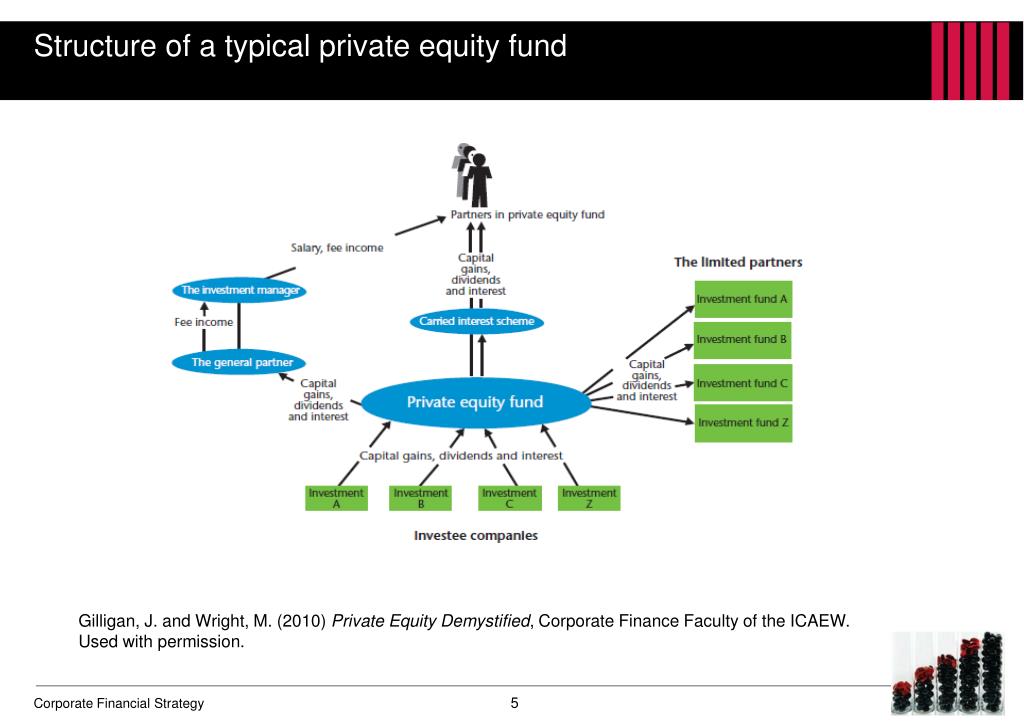

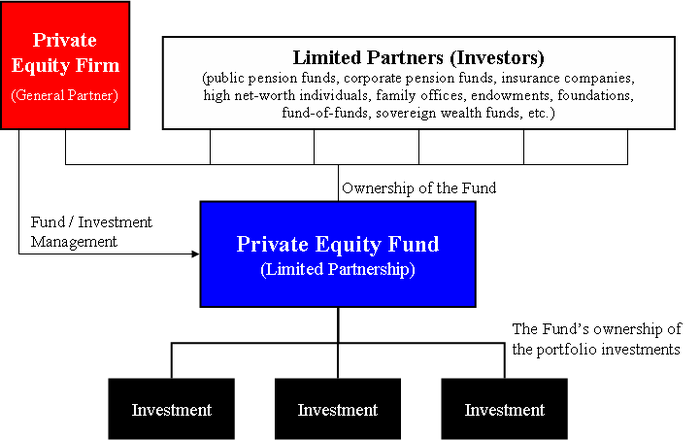

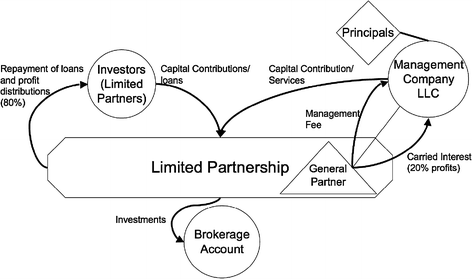

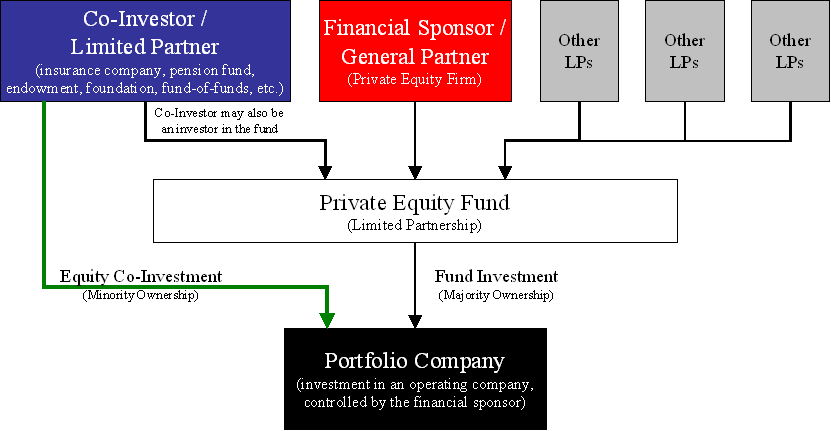

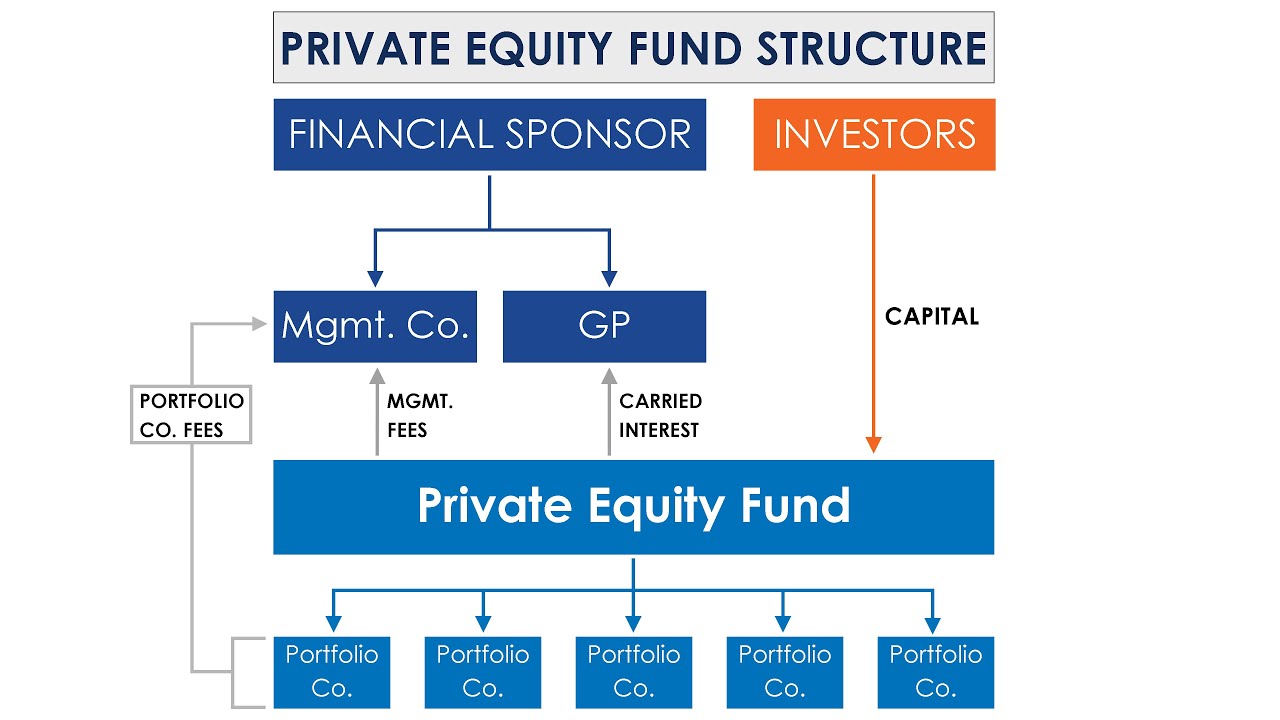

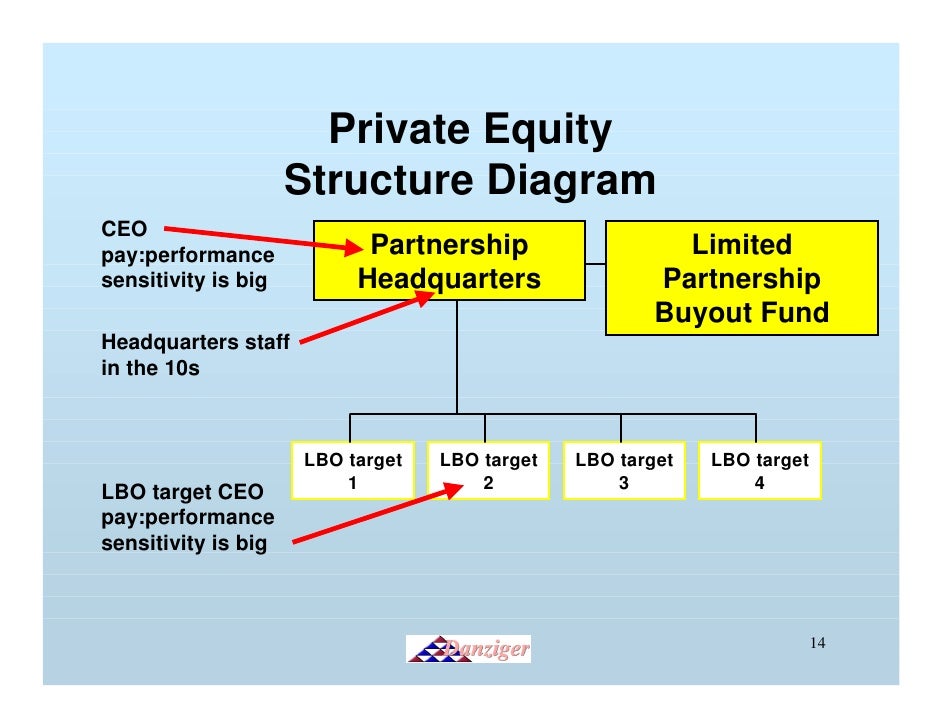

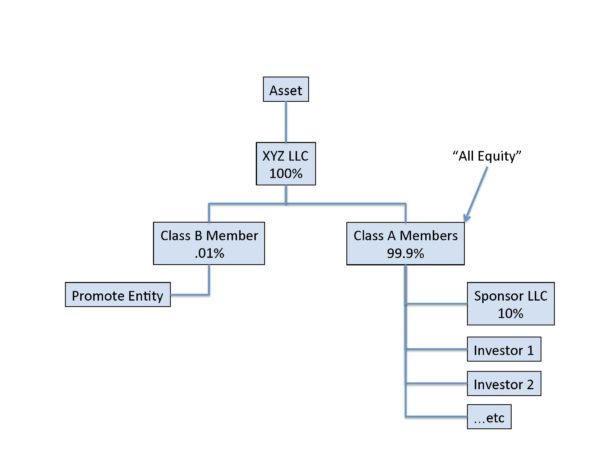

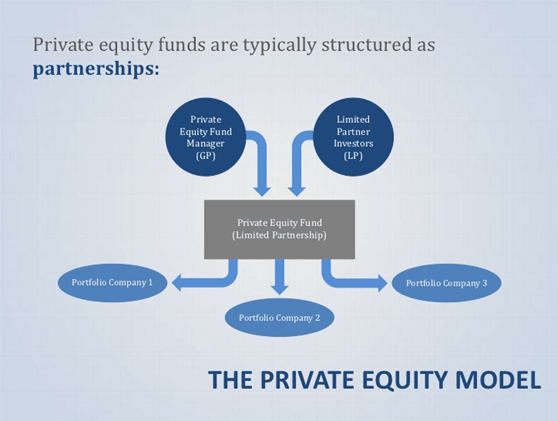

Private equity fund structure diagram. Private equity (PE) refers to a financing approach where companies acquire funds from firms or accredited investors instead of stock markets.What is a private equity and example?Is private equity bad? 1993. With the entry of private sector funds in 1993, a new era started in Indian Mutual Fund industry, giving the Indian investors a wider choice of fund and therefore giving rise to more competition in the industry. Private funds introduced innovative products, investment techniques and investors servicing technology during 1994. Vista Equity Partners Fund VII acquired Black Mountain Systems in July 2019 and subsequently merged Black Mountain Systems with AltaReturn, a leading provider of solutions for private capital fund managers, administrators and family offices, when AltaReturn was acquired in September 2019. Most venture and private equity funds use a limited partnership as their legal structure (Figure 2), which involves two main types of actors: (1) a general ...

For our study here six schemes have been selected: HDFC EQUITY FUND 59 SAAB MARFIN MBA ICICI PRUDENTIAL DISCOVERY FUND UTI OPPUTTUNITIES FUND IDFC PREMIER EQUITY PLAN A RELIANCE RSF FUND SUNDARAN BNP PARIBAS S.M.I.L.E REG- SCHEME PROFILE: HDFC EQUITY FUND AMC HDFC Asset Management Company Ltd. Fund Category Equity diversified … Diagram of the structure of a generic private-equity fund Although the capital for private equity originally came from individual investors or corporations, in the 1970s, private equity became an asset class in which various institutional investors allocated capital in the hopes of achieving risk-adjusted returns that exceed those possible in the public equity markets . A private-equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity.Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded ... Private equity firms, mutual fund companies, life insurance companies, unit trusts, hedge fund companies, and pension fund entities are examples of buy-side firms. read more) and showcasing their calls on the stocks. They have to diligently communicate buy sell recommendations of stocks.

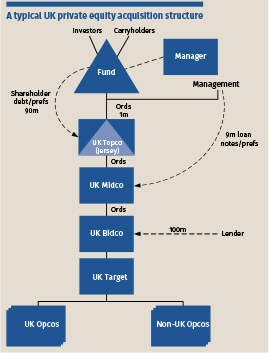

This practice note provides an overview of the basic structure of a typical private equity fund, highlights some differences between English and Luxembourg ...22 pages Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no ...16 Jan 2017 · Uploaded by A Simple Model 9 Jun 2020 — I. Introduction to Basic Entity Private Fund Structures ... conferences and more Partners Group Private Equity Master Fund is down -7.3% for ...11 pages Although minimum investments vary for each fund, the structure of private equity funds historically follows a similar framework that includes classes of fund ...Private Equity Fund Basics · Fees · Limited Partnership Agreement

11-04-2018 · The Equity Capital Markets Team Structure: 3 or 4 Teams in 1. Most people speak about ECM as if it’s a single group, but it is actually divided into a few different subgroups at most banks: Equity Origination: This team pitches companies on raising capital and then executes financing deals such as IPOs and follow-on offerings.

How the Master-Feeder Structure Works. The diagram below depicts how a typical master-feeder ... Creating a master fund generates economies of scale Economies of Scale Economies of scale refer to the cost advantage experienced by a firm when it increases its level of output.The advantage arises due to ... private equity, FP&A ...

Structure For Private Equity Fund Powerpoint Presentation Designs Slide Ppt Graphics Presentation Template Designs

Structure For Private Equity Fund Powerpoint Presentation Designs Slide Ppt Graphics Presentation Template Designs

Structure For Private Equity Fund Powerpoint Presentation Designs Slide Ppt Graphics Presentation Template Designs

Siscoserv Implications For Brazilian Private Equity Fund Managers September 20 2012 Peter A Furci Ppt Download

425 1 A08 20194 2425 Htm 425 Filed By Kkr Co L P Pursuant To Rule 425 Under The Securities Act Of 1933 As Amended Subject Company Kkr Private Equity Investors L P Registration No 333 144335 This Filing Contains Certain Forward Looking

Using A Combination Of Vehicles Private Equity Structures And Their Impact On Private Equity Accounting And Reporting Informit

19 Organization Compensation Regulation And Limited Partners Investment Banks Hedge Funds And Private Equity Book

Structure Of A Private Equity Fund Ppt Slide Themes Powerpoint Templates Download Ppt Background Template Graphics Presentation

0 Response to "41 private equity fund structure diagram"

Post a Comment