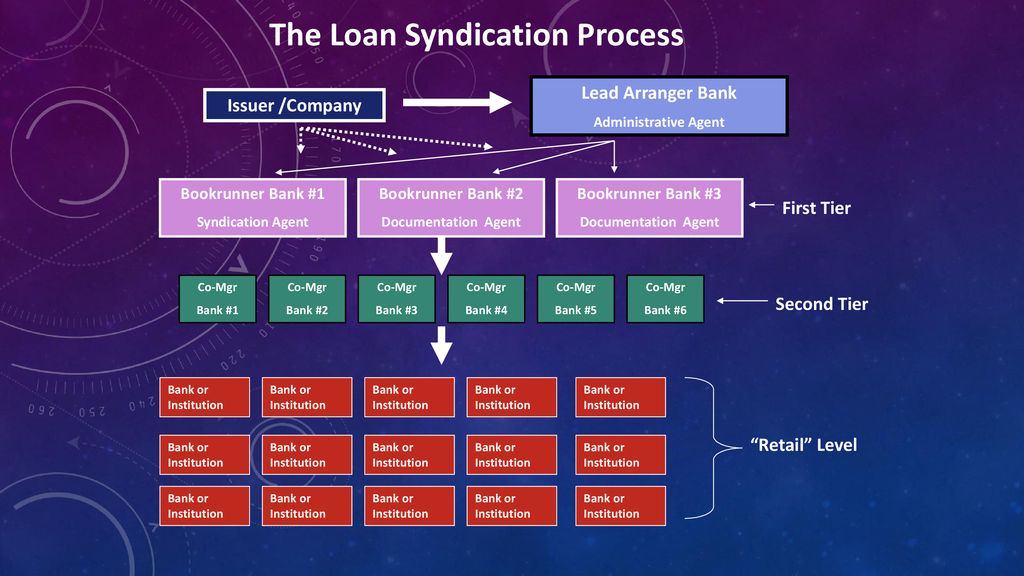

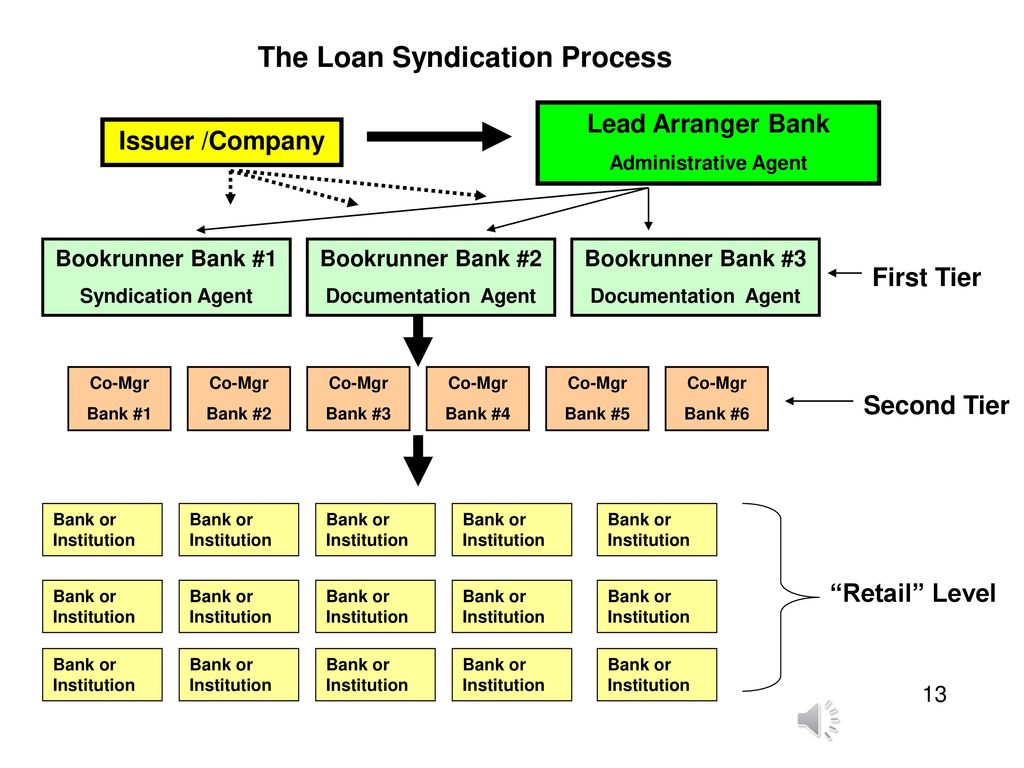

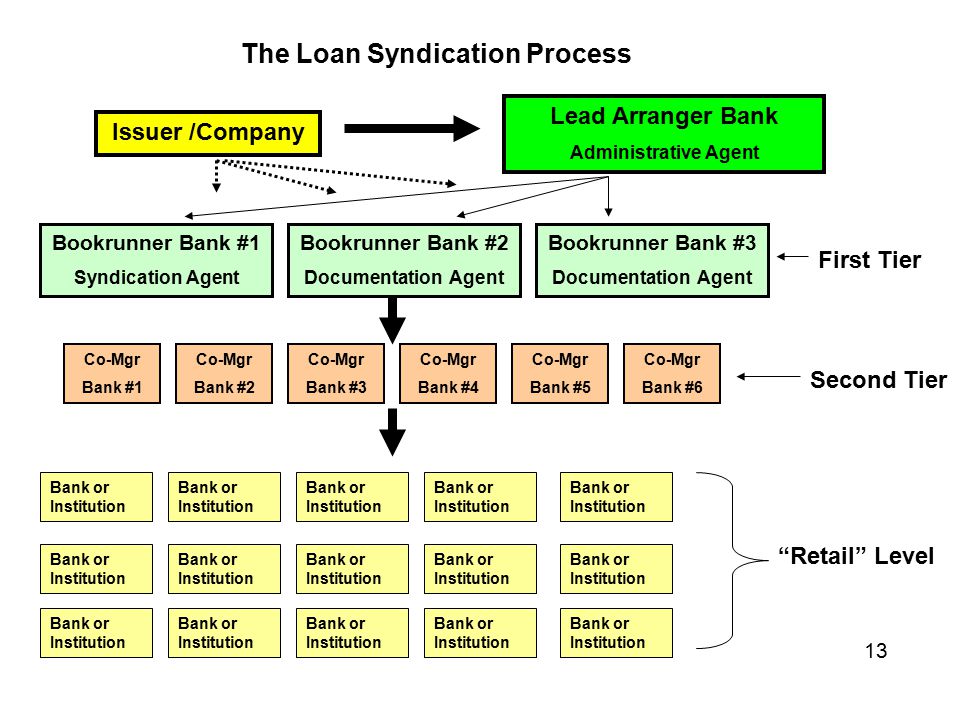

38 loan syndication process diagram

· FHA -> arduous process but great end results · Banks -> extremely competitive in CRA markets Agency Loan Options · Acquisition Bridge -> Freddie Mac, Banks and Proprietary Funds · Perm Loan -> Freddie TEL forward, Fannie immediate and HUD 223(f) PILOT or 221(d)(4) sub rehab

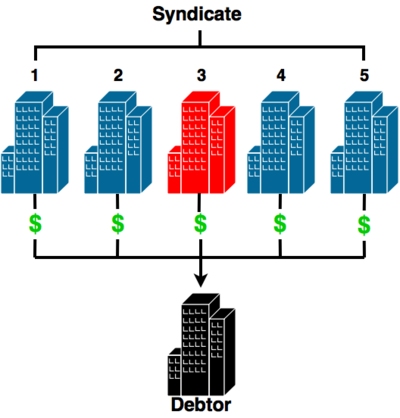

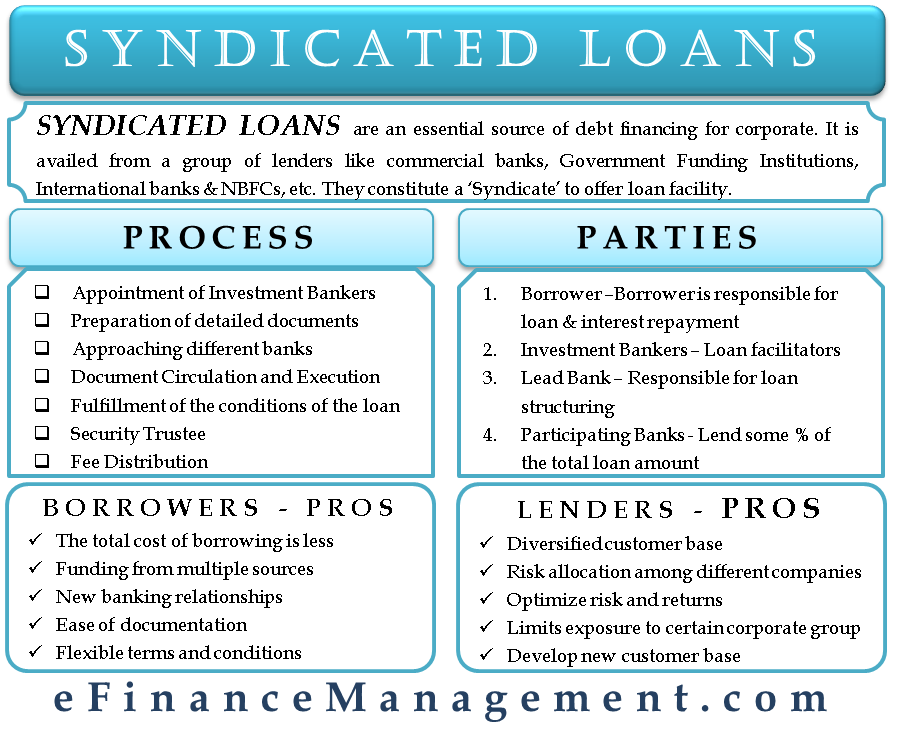

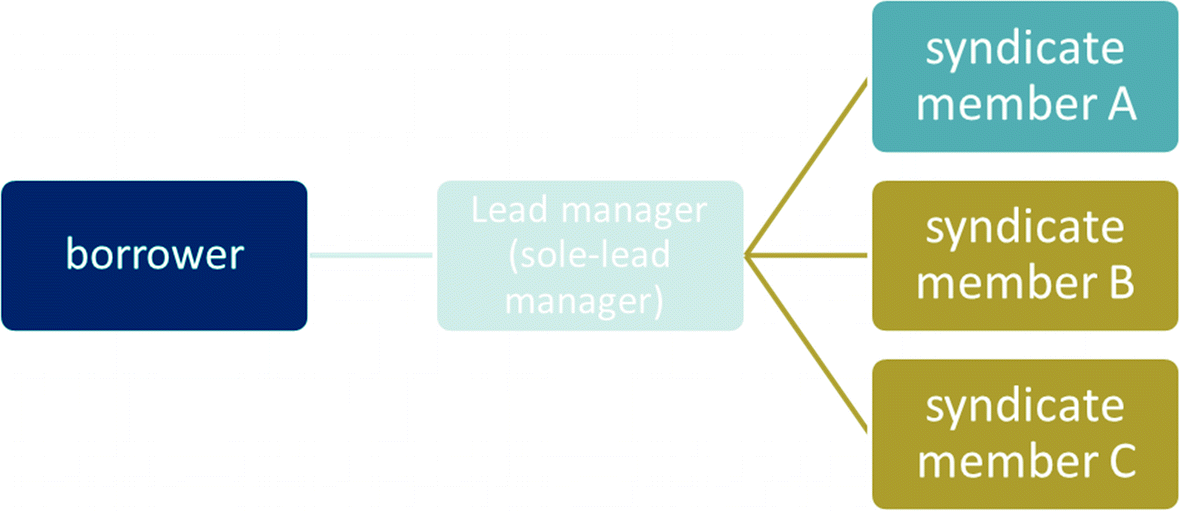

In Loan Syndication, a group of Banks provides loans jointly to a single borrower because one single bank cannot meet the huge requirement of the borrower as it may be beyond its risk exposure. This type of loan syndication process is required by large companies that are working on a large project and that project requires a huge amount of ...

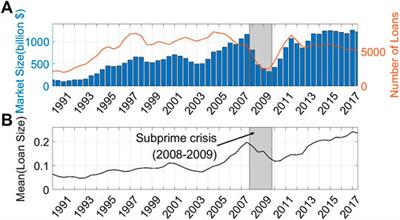

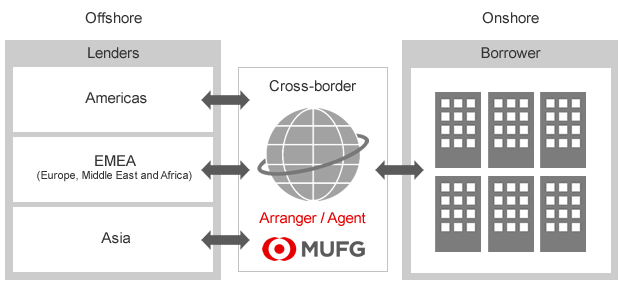

3 An international syndicated loan is defined in the statistics compiled by the BIS as a facility for which there is at least one lender present in the syndicate whose nationality is different from that of the borrower. 4 Syndicated loans are widely used to fund projects in these sectors, in industrial and emerging market countries alike.

Loan syndication process diagram

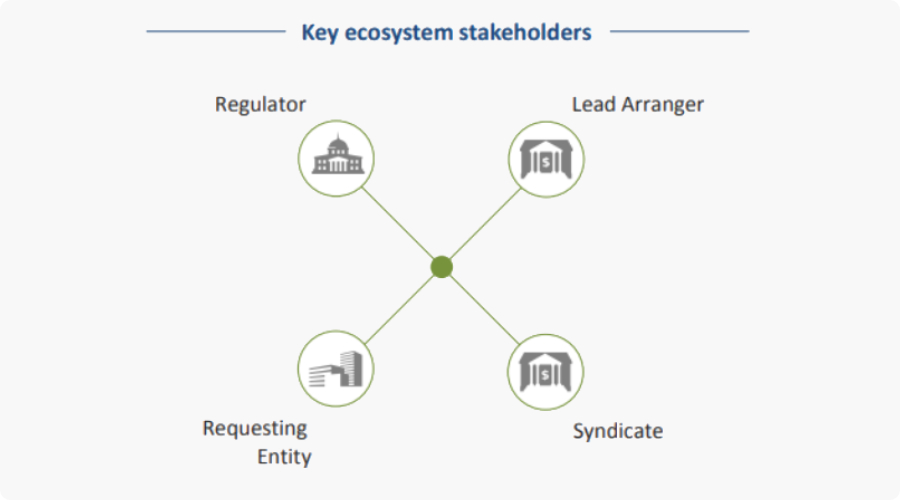

A syndicated loan, also known as a syndicated bank facility, is financing offered by a group of lenders (referred to as a syndicate) who work together to provide funds for a single borrower. The ...

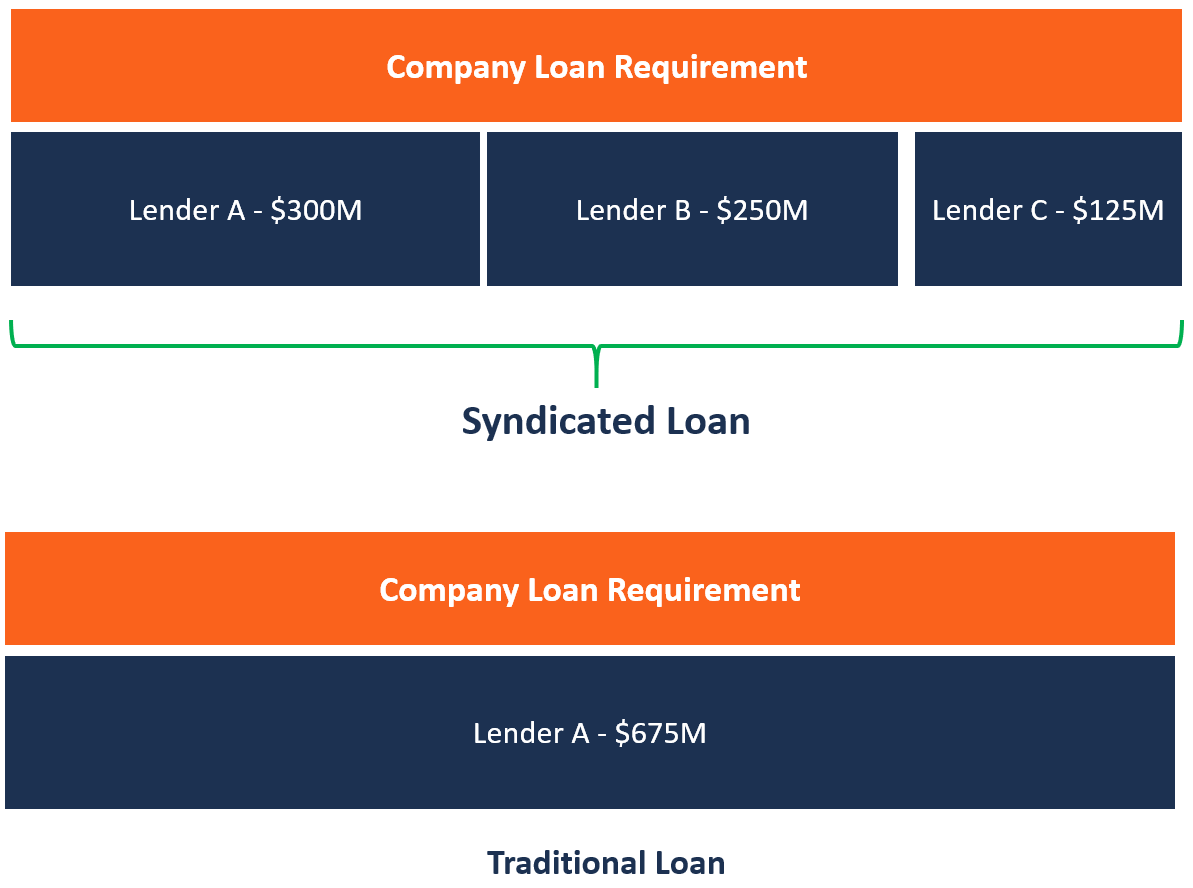

Loan syndication is the process of involving a group of lenders in funding various portions of a loan for a single borrower. Loan syndication most often occurs when a borrower requires an amount...

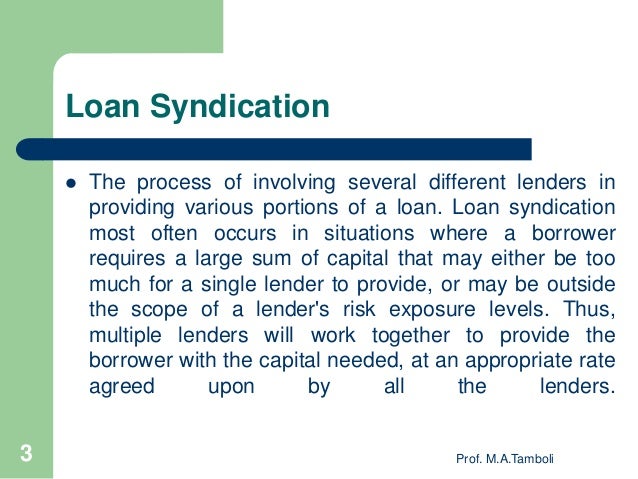

Loan Syndication Loan syndication is a lending process in which a group of lenders provide funds to a single borrower. 2 Prof. M.A.Tamboli 3. Loan Syndication The process of involving several different lenders in providing various portions of a loan. Loan syndication most often occurs in situations where a borrower requires a large sum of ...

Loan syndication process diagram.

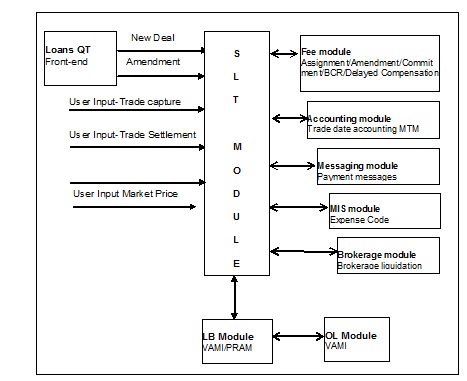

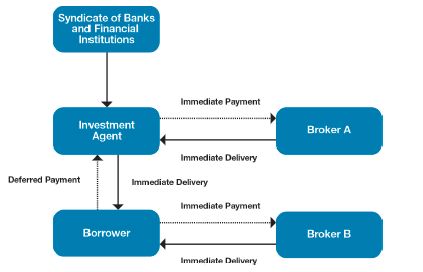

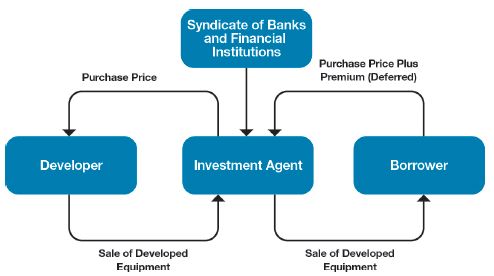

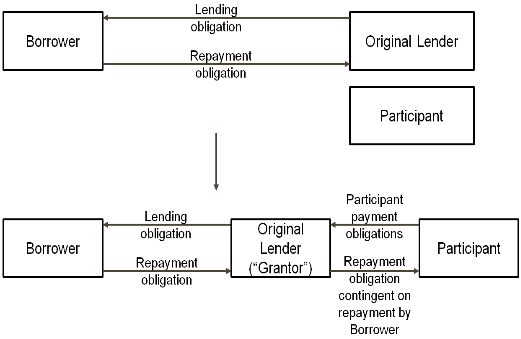

2.1.1 The Process of Disbursing a Syndicated Loan. The process in which the loan is disbursed (or the customer avails the loan) under a syndication agreement depends upon many factors. The most important factor is the nature of the requirement of the customer. The other factor is the identification of the participants who would share the load ...

Loan Syndication is the process where a bunch of banks and lenders fund various fragments of a loan of an individual borrower. Loan Syndication happens when a borrower requires a loan amount which is too big for a single bank to provide. Thus, a bunch of banks come together to form a syndicate and provide the necessary loan amount to the borrower.

What is a Syndicated Loan? A syndicated loan is offered by a group of lenders who work together to provide credit to a large borrower. The borrower can be a corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, sue and be sued, own assets, remit ...

Syndicated Loan and Loan Participations. By: Lisa D. Love, Esq., Partner, Love and Long, L.L.P. Loan syndications and loan participations continue to grow in commercial finance as lenders seek to expand beyond their traditional sources of revenue, enter new or developing markets and industries, maintain acceptable levels of diversification of its investments, and share development risks and ...

0 Response to "38 loan syndication process diagram"

Post a Comment